We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

How Long Does a Background Check Take for an Apartment? (Tip)

Table of Contents

First-time renters in the US often observe the challenges others encounter during the rental process and often inquire about the duration of a background check for an apartment. Since a background check involves checking many aspects of a potential tenant’s life, the time it takes varies depending on the steps involved and our guide will break down each scenario.

Whether seasoned professionals or young adults just stepping out into the world, all tenants should know what a background check entails, the possible rental application timeframe, how they can speed up the process, and the laws protecting them.

The number 1 tip for speeding up the process is conducting a free background check on yourself to know exactly what will show up. Once you receive your background check report, you will know exactly how to contact the apartment complex (or landlord) with the correct information to finish application and get moved in fast.

Why Is My Apartment Background Check Taking So Long? (Tenant Background Check Delays)

The landlord’s or property manager’s thoroughness and/ or policies are the main factors dictating how long a background check takes for an apartment. For some apartment complexes and properties, tenants might be able to get an apartment far more simply and quickly, while others are stricter with tenant background checks.

When a tenant completes a paper application for the apartment instead of an online one, it may take additional time for the information to pass between the landlord and the bulk background check company, potentially extending the processing timeframe.

If an employer requires references or employment verification, they may have trouble contacting referees or places of employment, further adding to the time taken for a background check.

How To Avoid Delays When Getting a Background Check for an Apartment

While some circumstances, like the type of application or references required, cannot be helped by the tenant, they can get their application processed quicker in a few ways:

- Respond to the background checking company quickly: Most landlords hire a company to do their tenant screening for them and this can cause some delays. Additionally, a background check for professional purposes requires written permission (although personal background checks can be conducted without explicit permission), and prospective tenants are advised to promptly respond to enable the apartment staff to initiate the background check promptly.1

- Fill out the form correctly and accurately: For example, if the tenant enters a “0” instead of a “9” in a referee’s phone number, the checking company will have to get back to the landlord for accurate information, who will then have to talk to the tenant about it and check all over again.

- Provide references that are easy to contact: If the tenant’s references are unreachable, it will delay the entire background check process as they have to provide new references.

- Check the apartment’s rent-to-income ratio: Most landlords list a rent-to-income ratio for applicants, which is the amount the tenant must earn every month to be approved for the apartment. Usually, this amount is 3-4 times the rent per month.2

- Check your credit score: A potential tenant must check that their credit score is good (or at least decent) before applying for a rental. This can be done with a credit check service or third-party applications like Credit Karma. If their score is low, they should be ready to explain why while applying. This score is a measure of trust in the landlord as it indicates a history of timely rent payments.

So when wondering about the background check timeframes and turnaround times for an apartment, be sure you’re not the one causing any delays.

What Does an Apartment Background Check & Tenant Screening Consist Of?

Since it’s a multi-step process and varies from property to property, how long a background check takes for an apartment depends on the thoroughness of the background check. The following information is included in most tenant background checks.

ID Check: Most services will ask for a tenant’s Social Security Number (SSN) to confirm their identity.

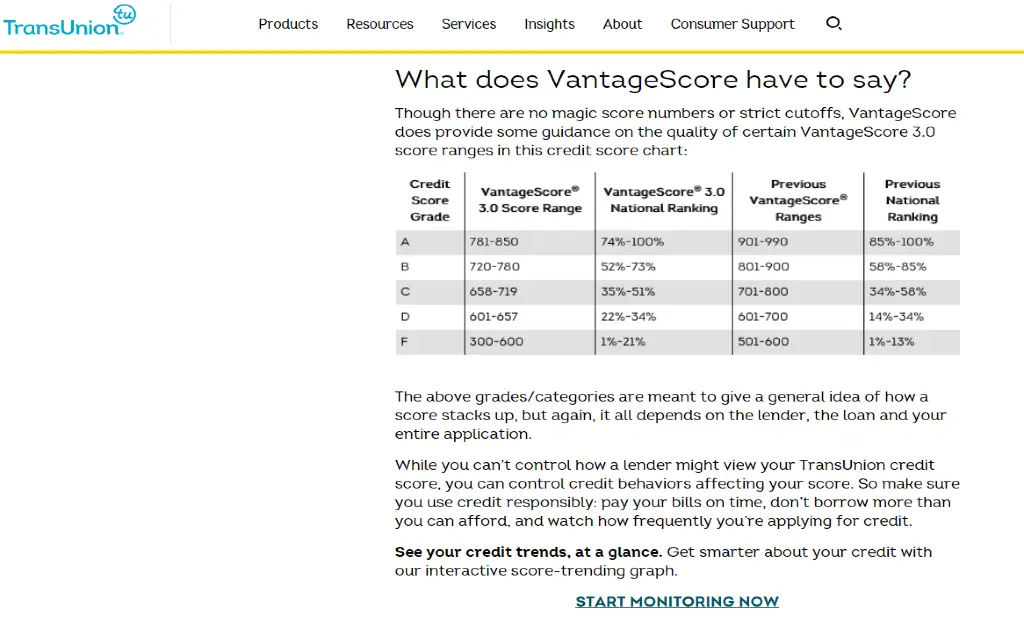

Credit Check: A tenant’s credit score indicates their history of managing lines of credit and ongoing payments. This history demonstrates whether or not a renter will pay their rent on time. Credit reporting bureaus like Equifax, Experian, and TransUnion provide this score.

Credit unions calculate this score majorly through payment history (40%), though credit utilization, length of credit history, number of recently reported balances, and new credit accounts also play a part.3 It ranges from 300 to 850 and is divided into:

- Bad: 300-550

- Poor: 550-650

- Fair: 650-700

- Good: 700-750

- Excellent: 750-8504

Credit checks may also include tradelines (credit cards, mortgages, etc.), account balances, and if a tradeline went to collections (was not paid for around six months).

If the score is low for a legitimate reason, tenants will be able to provide this information to the landlord and the credit union via a consumer statement.

Job and Address History: Many companies have access to over 200 million citizens’ job and address records, which they can verify through the information the applicant provides. However, not all of this information may be accurate, and the applicant can correct it if needed.

Income Verification: Many services will require income verification through pay stubs or bank statements, To verify that a tenant’s income fits the landlord’s rent-to-income ratio.

Rental History: Evictions are expensive for lenders, and past evictions are the surest predictor of future evictions. However, landlords must remember that a person’s financial situation may have improved since the previous eviction and remember to judge on a case-by-case basis.

Eviction records are public in most states, which means companies can extract them from a database of state eviction records. They usually provide:

- Evictee’s name

- State

- Address where the eviction took place

- Case file number

- Summary of the judgment

- Date

Criminal History: All companies will provide a tenant’s federal and state criminal history across the USA, and many will also indicate whether a tenant’s name appears in a terror or sex offender registry.

This history will show the tenant’s arrests and convictions (when the person was charged with a crime after trial). According to the Fair Credit Reporting Act (FCRA), however, only arrests made within seven years of the history request can be reported. Convictions, on the other hand, can be reported indefinitely.5

The Fair Housing Act also dictates that landlords cannot deny tenants housing solely based on criminal history. They also cannot impose a blanket ban on anyone with a criminal record. Instead, they have to prove that the tenant’s convictions indicate they’ll disturb the peace or damage the property.6

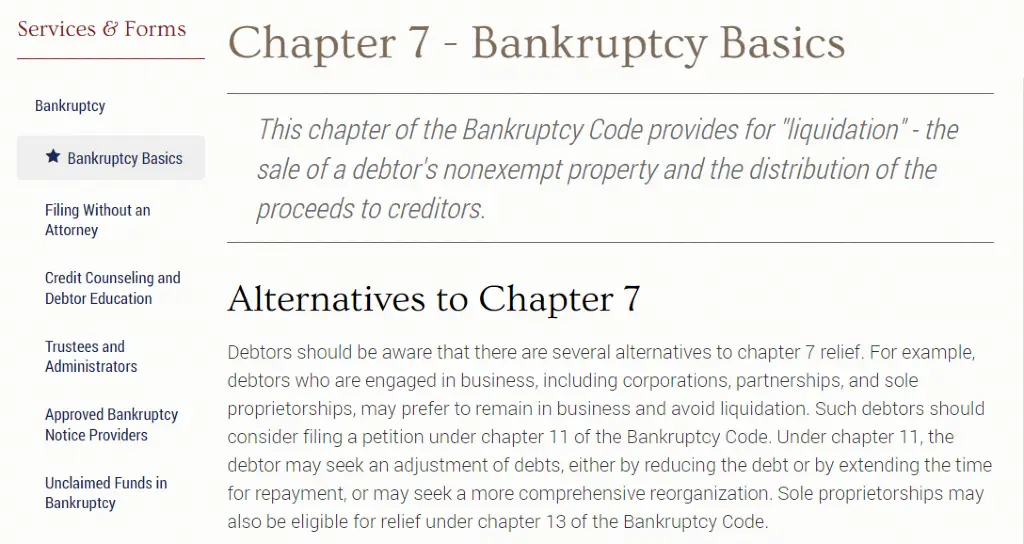

Bankruptcy Records: Many background checks will also include bankruptcy records, which can be either a Chapter 7 or Chapter 13 bankruptcy.

- Chapter 13: Indicates full or partial repayment and remains on the records for seven years.8

When considering whether background checks include tax records, it’s worth noting that in certain instances, civil judgments and tax liens (unpaid taxes) could be included, although this is not common in most cases. If required, a company will have to run a separate search for these records.

Credit Inquiries: When a person or a company checks a tenant’s credit score, it creates an inquiry. Soft inquiries occur when the tenant requests their own credit score and do not impact the score.

Hard inquiries, however, do affect it. These are created when the person applies for a new credit card, student or auto loans, mortgages, etc. These inquiries can be helpful when trying to gauge someone’s current lines of credit.

Adverse Items: A credit report can include due payments, unpaid tradelines, charge-offs, collections, bankruptcies, foreclosures, repossessions, wage garnishments, etc., all of which contribute to adverse credit history.

Tenant Verifications That Are Not a Part of Rental Background Checks

While rental background check companies will handle most aspects of tenant screening, landlords will still verify some information manually. Therefore, it’s prudent to make sure these aspects are in line before stressing about how long an apartment background check may take:

- Identity verification: While many background check services will ask for an SSN, renters can also prove a tenant’s identity themselves through their driver’s license or passport. Tenants will usually be required to produce some form of government-issued ID.

- Employment verification: Background check services cannot verify employment history or status that is not yet part of a database. Some landlords may take the tenant’s consent to contact their employer. Most will verify this information through a work verification number or the employee’s W-2 tax form.9

- References: Most landlords require references attesting to a tenant’s character and rental history. Usually, this reference will be a previous landlord, but for first-time renters, it can be an employer, a co-worker, etc. Landlords can contact these referees before granting a rental.

Apartment Rental Background Check Timeframes

Since a tenant screening can consist of so many different steps, how long a background check takes for an apartment depends on what the landlord or screening agency checks. Each step takes approximately:

- ID Verification: Instant. A Social Security Number (SSN) is a direct link to an applicant’s identity.

- Credit Check: Ideally, a few minutes, but can take 1-2 days. Credit reporting agencies typically present instant reports, but it can take time to clarify if there is an issue with it.

- Criminal History and Civil Records: 1 hour-3 days. Some records are easier to find than others, but most are available in the agency’s vast database.

- Eviction Records: 1 hour-3 days. These records are public, but some can take longer to find.

- Job and Income Verification: 1-3 days. Not all landlords will verify income with the employer – if they accept pay stubs as enough proof, confirmation should be instant.

- References: Depends on the referees but should not take more than a week unless there is a problem.

Most background checking agencies will have a turnaround time of 1-2 business days. However, it might take longer for the rental application to process if the landlord is screening tenants themselves or if there was an error while filling out the application.

Previous landlord references take the longest to verify most of the time since there is no guarantee when the referee will call back. Sometimes, landlords end up playing phone tag with referees for days.

Income verification may also be an issue, as some workplaces may not give out this information. Hence, it’s good to have recent pay stubs and bank statements handy.

The time it takes to get a background check for an apartment is ideally no more than one week. But if there are any inaccuracies in the form or the landlord cannot reach referees, it might drag on for several weeks.

Tips To Pass & Expedite Rental Apartment Background Checks

Applying to rent an apartment is stressful at the best of times and can be even more of a headache if the tenant is in a hurry. Plus, they almost always cost a fee, so sending out multiple applications quickly gets expensive.

So, save time, money, and headache by doing these simple things to give your application the best chance of success and streamline the amount of time it takes to get your apartment background check report back.

1. Understand Tenant Background Check Laws in Your State

While some laws are applicable at a federal level (FCRA, Fair Housing Act), some states have exceptions or additions that only apply in that state. Knowing these laws can help figure out how long apartment background checks typically take:

Fair Credit Reporting Act (FCRA): All tenant screening agencies must comply with the FCRA. Besides criminal history, this law also applies to credit checks, rental history, references, etc.

If the landlord takes an adverse action, i.e., denies an application or adds another stipulation like a co-signer or a larger deposit, the consumer reporting agency must send an adverse action notice to the tenant.10

This notice outlines what information the landlord used to make this decision and lays out the tenant’s right to dispute inaccuracies in this information.

Fair Housing Act (FHA): The FHA of 1968 protects tenants from discrimination while renting. Apart from criminal history, it lays out that landlords cannot deny tenants accommodation based on a protected class: race, color, religion, national origin or ethnic background, gender, familial status, and mental or physical disability.11

If a tenant suspects that the landlord denied them housing or required a larger deposit solely because they belong to a protected class, they can pursue a case against them.

The FHA does not apply to a property with less than five rental units where the owner also resides. This stipulation is known as the Mrs. Murphy Exemption, and its application varies by state.

Apart from these laws, each state may also have its own unique tenant screening regulations, as outlined below.

2. Check for Disqualifications Before Applying (Run a Background Check On Yourself)

It’s a good idea to run a tenant background check on oneself before applying for a rental. It’s best to use a reputable tenant screening site since they’ll give the tenant all the same information they’d give a potential landlord.

If the tenant finds any information which might disqualify their application, they can try to fix it before applying or provide an explanation for it if asked. For example, potential renters can try to improve their credit score before they apply for an apartment by paying off any outstanding debts. They can also wait 7 years after the negative information was initially reported since most negative information will drop after the seven year mark.

Additionally, some creditors or collection agencies will remove negative information from an individual’s credit report upon paying off the debt. This is referred to as “pay to delete” and can dramatically increase credit scores if they agree so it’s is surely worth exploring.

3. Avoid Opening New Lines of Credit Right Before an Application

Opening new lines of credit negatively affects a credit score, so if a tenant takes out a loan or buys a car before applying for a rental, they may have a lower credit score than they usually would. This would negatively affect their chances of being accepted.

Instead, keep credit payments consistent and avoid taking out any new loans before applying for an apartment. Lastly, hard inquires (loan or credit applications) fall off credit reports after 2 year and if you’re near the 24 month mark and able to hold off on moving, you may want to consider waiting a few more months before applying for the apartment.

4. Know How Far Back Most Background Checks Go for Apartments

Most background checks go back ten or more years but certain information is capped at seven years.

Consumer reporting agencies can only report credit history for 7-10 years and bankruptcy information for ten years. Adverse items, such as defaulted loans or missed payments, will remain on a tenant’s credit history for seven years.

When it comes to criminal history, criminal convictions can be reported indefinitely, but arrests will also only appear for seven years. Evictions also stay on the tenant’s public record for only seven years.12

5. Keep Proof & Documentation Handy

Always keep any documents that the landlord may need for rental verification handy. These documents may include pay stubs, bank statements, proof of employment or work verification number, government-issued IDs, etc.

If your credit score is low due to a valid reason such as identity fraud and you have filed a police report accordingly, you may be wondering whether police reports appear on background checks. No matter the case or if it shows, be sure to provide the police report to the landlord and inform the credit bureau with a consumer statement. Doing this will ensure that a bad credit score caused by means outside the tenant’s control does not count against them.

Also, if the tenant has a previous criminal but has rebuilt their life, they can provide testimonials from their employers, co-workers, friends, family, etc., to show good character.

6. Apply for Second-Chance Apartments

Tenants can apply to second-chance apartments if they have significant disqualifiers on the background check, like a bad credit score, multiple evictions, or an extensive criminal history.13

These apartments help tenants with a less than ideal background build up their credit history and establish a precedent to find better apartments in the future. Remember, credit histories only go back 7-10 years, so with time, it’s possible to leave bad rental history behind.

7. Be Honest With Your Landlord

Many people have a past of some sort so failing an apartment background check is not the end-all-be-all of a rental application. Keep in mind that landlords are only human, and if tenants are open and honest, they might be willing to look past certain disqualifiers.

Now that you are aware of how long background checks for apartments take, it’s just a matter of taking the first steps towards passing your application. If done right, you should be able to pass the background check quickly and swiftly so there’s no undue stress over rental applications taking a long time!

References

1 Kagan, J. (2021, September 21). Fair Credit Reporting Act (FCRA) Definition. Investopedia. Retrieved May 23, 2022, from <https://www.investopedia.com/terms/f/fair-credit-reporting-act-fcra.asp>

2 Collatz, A. (2018, August 2). Rent To Income Ratio Guide For Landlords | SmartMove. TransUnion SmartMove. Retrieved May 23, 2022, from <https://www.mysmartmove.com/SmartMove/blog/rent-to-income-ratio.page>

3 TransUnion. (2022). What is a Credit Score & How is it Affected. TransUnion. Retrieved May 23, 2022, from <https://www.transunion.com/credit-score>

4 TransUnion. (2022). What is a Good Credit Score. TransUnion. Retrieved May 23, 2022, from <https://www.transunion.com/article/what-is-a-good-credit-score>

5 Maurer, R. (2019, June 12). FCRA’s Seven-Year Reporting Window Begins with Charge, Not Dismissal. SHRM. Retrieved May 23, 2022, from <https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/fcra-seven-year-reporting-window-begins-with-charge-not-dismissal.aspx>

6 National Association of Realtors. (2020, January 9). Fair Housing Act: Criminal History-Based Practices and Policies. National Association of REALTORS®. Retrieved May 23, 2022, from <https://www.nar.realtor/articles/fair-housing-act-criminal-history-based-practices-and-policies>

7 US Courts. (2022). Chapter 7 – Bankruptcy Basics | United States Courts. United States Courts |. Retrieved May 23, 2022, from <https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-7-bankruptcy-basics>

8 Courts. (2022). Chapter 13 – Bankruptcy Basics | United States Courts. United States Courts |. Retrieved May 23, 2022, from <https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-13-bankruptcy-basics>

9 Office of the Assistant Secretary for Administration & Management. (2022). Employment Verification. US Department of Labor. Retrieved May 23, 2022, from <https://www.dol.gov/agencies/oasam/centers-offices/human-resources-center/employment-verification>

10 Consumer Financial Protection Bureau. (2022). A Summary of Your Rights Under the Fair Credit Reporting Act [PDF]. Consumer Finance. Retrieved May 23, 2022, from <https://files.consumerfinance.gov/f/documents/bcfp_consumer-rights-summary_2018-09.pdf>

11 US Department of Justice. (2022, January 13). The Fair Housing Act. Department of Justice. Retrieved May 23, 2022, from <https://www.justice.gov/crt/fair-housing-act-1>

12 Consumer Financial Protection Bureau. (2021, July 1). How long can information, like eviction actions and lawsuits, stay on my tenant screening record? Consumer Financial Protection Bureau. Retrieved May 23, 2022, from <https://www.consumerfinance.gov/ask-cfpb/how-long-can-information-like-eviction-actions-and-lawsuits-stay-on-my-tenant-screening-record-en-2104/>

13 Second Chance Apartments. (2022). Second Chance Apartments. Second Chance Apartments, 2nd Chance Apartments Locators for Bad Credit. Retrieved May 23, 2022, from <https://secondchanceapartments.com/>