How To Find Where Someone Works for Garnishment (Guide)

Understanding the process of locating someone’s workplace is beneficial for parents with custody seeking the non-custodial parent, or for individuals dealing with debts owed to entities like banks, medical facilities, or universities.

In any case, anyone can easily run a background check on someone to find out who their employer is, if they have criminal charges against them, if they’re remarried and more; all it takes is their first and last name.

There’s additional ways someone can find someone’s employer as well so this full guide reveals how to find someone’s employer, what government resources are available, how garnishment works, and the limits placed on garnishment too.

What Is Wage Garnishments & When Is it Necessary?

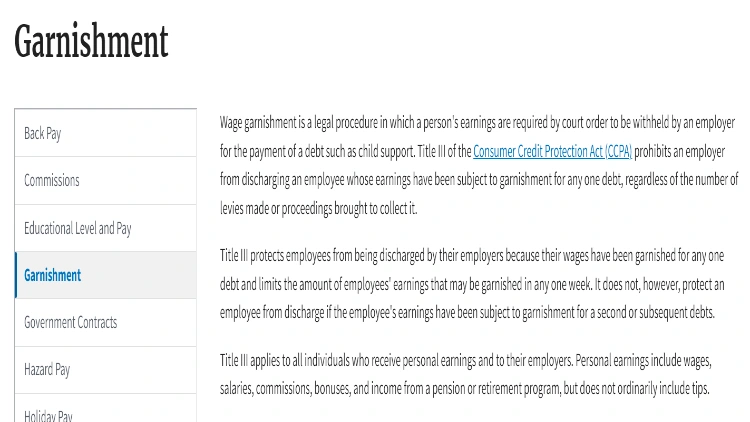

Wage garnishment is simply a legal term for when an entity can have an employer withhold a certain amount of money from a person’s paycheck to satisfy a financial obligation as outlined by state laws.

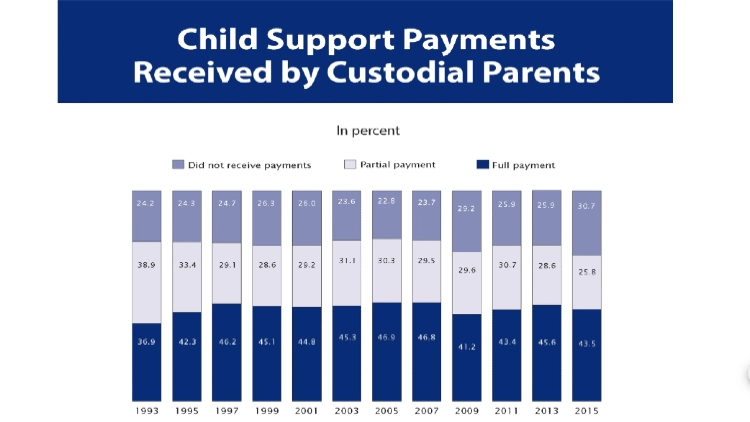

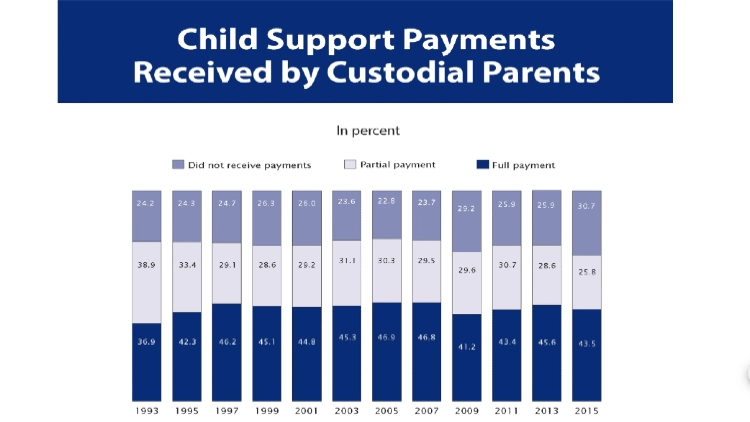

When considering more 13 million custodial parents are due child support and consumer debt is more than 16.5 trillion dollars nationwide, this is especially important for individuals and institution hoping to retrieve the debt owed.1

To start the process, the creditor or non-custodial parent needs to know how to find out where someone works for wage garnishment to take place. The garnishment laws not only outline what types of defaulted (or unpaid) debts can lead to wage garnishment, they also spell out how much of a person’s paycheck can be garnished.

One of the most common reasons for garnishment of wages is due to unpaid child support. Since almost 33% of all families due child support receive nothing from the individual ordered to pay, garnishment is a tool child support enforcement agencies in each state can use to compel payment.1

Understanding the procedure for identifying an individual’s employer is crucial, as it is essential for enforcing payment of outstanding debts. This knowledge facilitates the collection process significantly.

Some states also allow garnishment for other reasons such as defaulted student loan debts, ambulance bills, and consumer debts but they can also be used for unpaid taxes.

Garnishment may be from wages or from financial institutions where the individual subject to the action has a checking or savings account.

State laws define what income sources can be garnished to pay the financial obligation or obligations that a person has been refusing to pay. The table below shows what types of debts can lead to garnishment in each state, how much of a person’s wages can be garnished, and any other limitations.

| State |

Garnishment Statute |

Debts That Can Lead to Garnishment |

Amount of Wages That Can Be Garnished** |

Income Exemptions* |

| Alabama |

6-10-7 |

Child Support

Federal Student Loans

Unpaid Taxes |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Alaska |

09.38.035 |

Child Support

Federal Student Loans

Unpaid Taxes |

Up to 25% of gross income from wages |

Debtor can request an exemption for up to $350 a week in wages from garnishment |

| Arizona |

33-1131 |

Child Support

Federal Student Loans

Unpaid Taxes

Spousal Support

Vehicle Registration

Court-Ordered Debts |

Up to 25% of gross income from wages |

Filing for bankruptcy may remove the garnishment from a person’s wages. |

| Arkansas |

16-110-415 |

Child Support

Federal Student Loans

Unpaid Taxes

Unpaid Medical Bills |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| California |

California Code Chapter 5 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Colorado |

5-5-105 |

Child Support

Federal Student Loans

Unpaid Taxes |

Up to 20% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Connecticut |

52-361a |

Child Support

Federal Student Loans

Unpaid Taxes

Spousal Support

Court-Ordered Debt

Vehicle Registration |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds

Crime Victim Compensation

Interest in cash-value life insurance policies |

| Delaware |

Wage Payment and Collection Act |

Child Support

Federal Student Loans

Unpaid Taxes |

Up to15% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Florida |

Chapter 77 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debts |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds

Head of Household Wages

Worker’s Compensation

College Fund Savings |

| Georgia |

18-4-4 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Hawaii |

Chapter 652 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Idaho |

Chapter 7 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Illinois |

735 ILC 5 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Indiana |

22-4-13.3 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Iowa |

Chapter 642 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Kansas |

60-2310 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Kentucky |

425.501 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Louisiana |

Chapter 4 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Maine |

Title 9A, 5-105 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt (unless the interest rate exceeded 33%) |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Maryland |

Rule 3-646 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Massachusetts |

Part III, Title IV, Chapter 246, Section 28 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to15% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Michigan |

Section 600.4012 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Minnesota |

Section 571.72 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Mississippi |

85-3-4 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Missouri |

525.040 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Montana |

25-13-614 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Nebraska |

25-1558 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Nevada |

Chapter 31 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| New Hampshire |

282A:152-a |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| New Jersey |

2A:17-50 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to10% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| New Mexico |

35-12-1 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| New York |

NYCLPR 5231 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to10% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| North Carolina |

105-242 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to10% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| North Dakota |

32-09.1 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Ohio |

Chapter 2716 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Oklahoma |

12-1173.4 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Oregon |

Chapter 0249 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Pennsylvania |

Act 46 of 2003 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Rhode Island |

10-5-8 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| South Carolina |

Title 37, Chapter 5 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to15% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| South Dakota |

21-18-27.1 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 20% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Tennessee |

69.05 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Texas |

Chapter 63 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Utah |

63A-3-507 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Vermont |

3208 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Virginia |

16VAC15-21-30 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Washington |

25.60 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| West Virginia |

46A-2-130 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Wisconsin |

812.34 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

| Wyoming |

HB0013 |

Child Support

Federal Student Loans

Unpaid Taxes

Court-Ordered Debt |

Up to 25% of gross income from wages |

State or federal government benefits

Pensions or Retirement Funds |

*Social Security and SSI can be garnished for child support and government debts (for example, student loans that were not forgiven due to disability)

**Withholdings for child support can be up to 50-65% of the person’s disposable income

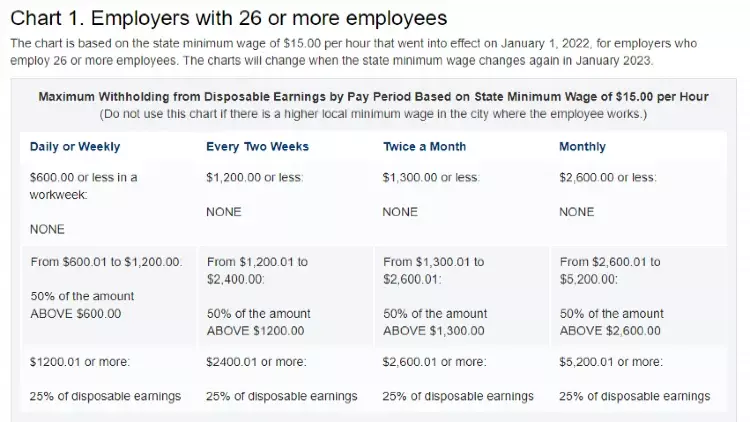

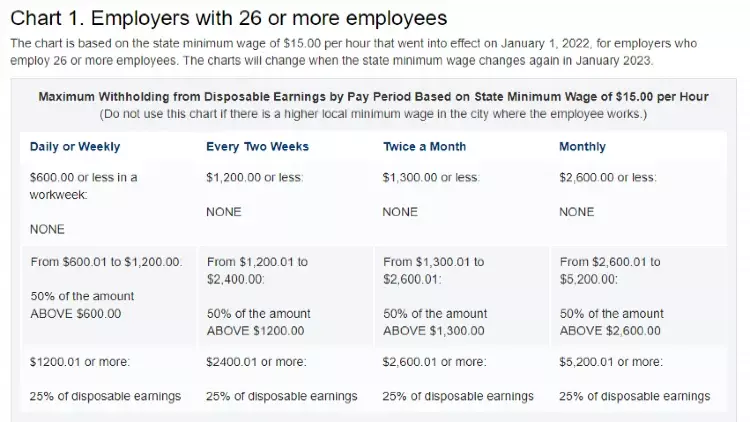

California garnishment limitations and maximum withholding for employers with 26 or more employees.

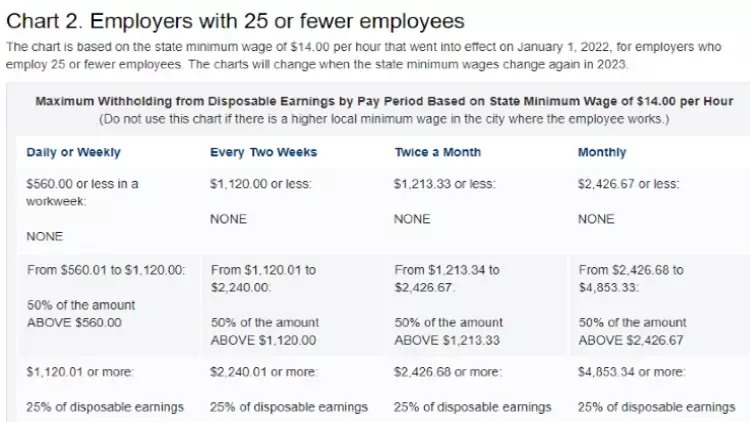

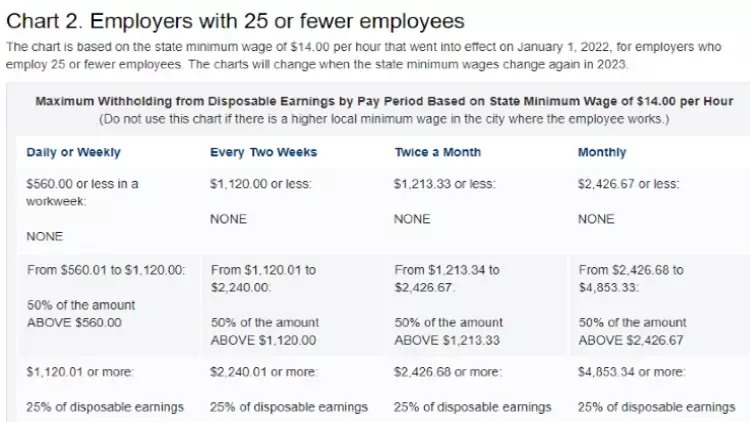

The maximum garnishment withholding amounts in California for employers with less than 25 employees.

Knowing the law is only one part of the garnishment process. If someone is trying to find the other biological parent for child support, they need to know where the person works.

How To Find Out Where Someone Works for Child Support Wage Garnishment

The most important step in wage garnishment for child support is understanding how to find out where someone works in order to submit the request for garnishment or submit the garnishment order when a court order is required.

There are several ways a person can learn where a person is working.

State Child Support Enforcement Agency

In every state, there is a child support enforcement agency or entity that plays a crucial role in locating where someone works and initiating the garnishment process. This agency also assists in determining residency for the purpose of serving court notices regarding child support.

Child support enforcement agents have access to databases that are not available to the public such as new hire databases and the Federal Parent Locator Service and know how to find out where someone works for child support.

Additionally, if court involvement is required to garnish wages for child support, the child support enforcement agency attorney will file the necessary paperwork and argue the matter in court. This ensures the paperwork is completed and filed properly and increases the chances the court will order wage or bank account garnishment.

Office of Child Support Enforcement (OCSE)

The federal Office of Child Support Enforcement works with state child support enforcement agencies to get money to families that have a valid child support order. The Office of Child Support Enforcement maintains the Federal Parent Locator Service (FPLS) database and ensures state compliance with accessing the database and using the information obtained.

Agents with state child support enforcement programs are adept at identifying individuals’ employment locations for garnishment purposes using the FPLS, and have authorized access to the database.

OCSE also has a link for custodial parents to apply for child support or change child support orders, and find the local child support enforcement agency to help with garnishment of wages.

The OCSE not only maintains the federal new hire registry, but it also maintains a listing of all active child support orders nationwide. This allows child support enforcement agents to see orders from other states when the individual ordered to pay has moved in an attempt to avoid payment

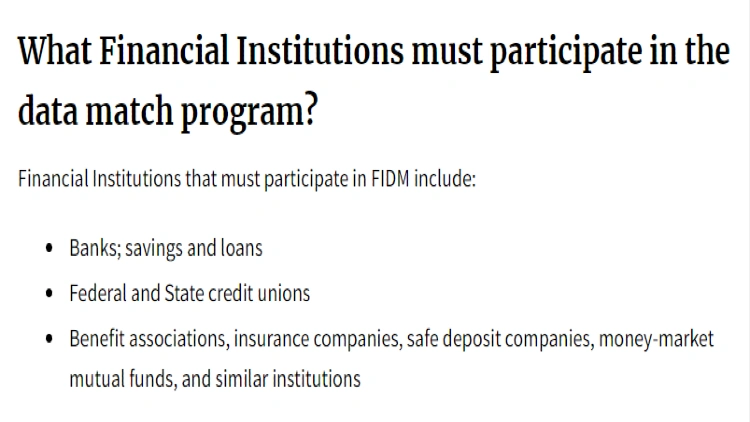

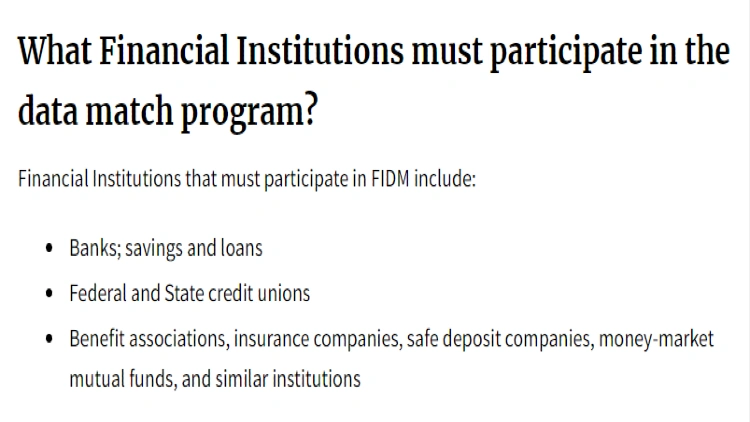

It also administers the Multistate Financial Institute Data Match for garnishment of bank accounts when ordered.2

New Hire Database

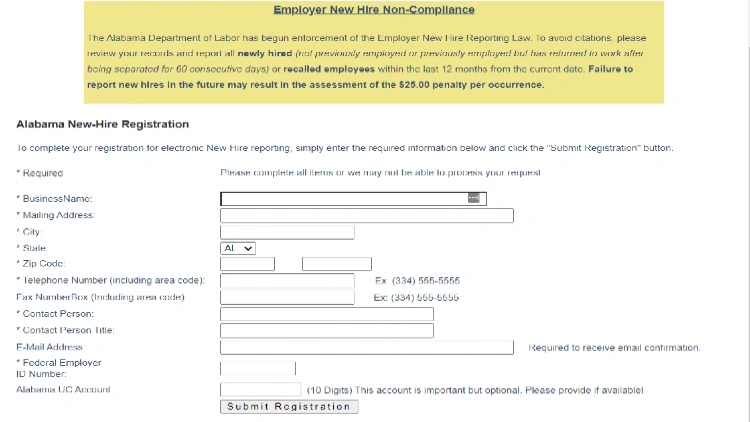

Each state maintains a new hire database which employers must report to when they take on a new employee and the respective database may be maintained by the state’s department of labor, or the local child support enforcement agency.

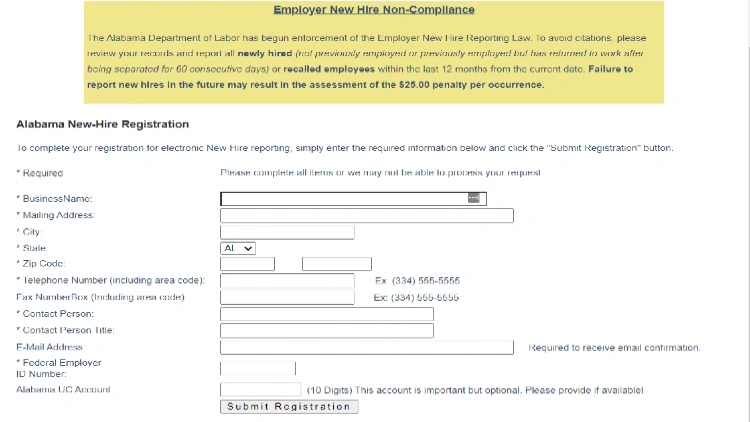

For example, Alabama’s Department of Labor maintains the new hire database for that state, and information can be accessed by local child support agents, attorneys or the courts for child support matters.

Hawaii, however, has its new hire database maintained by the child support enforcement agency in that state. Delaware places the responsibility for maintaining the new hire database with the Department of Health and Human Services in that state.

New hire database information is shared with the United States Department of Health and Human Services (USDHHS) for purposes of child support enforcement, wage garnishment, and tracking employment across state lines.

It also provides guidance to employers on reporting requirements and how to enter data.3 The USDHHS also offers guidance on locating individuals’ workplaces for garnishment in child support cases.

Personal Search

Individuals can pay a third party agency to conduct a search to find out where a person is working; however, the information in this search may or may not be current. Some third-party searches also will not reveal place of employment, and do not provide wage information.

Individuals can also conduct their own search of social media sites to see if they can locate the person’s place of employment. This type of search can be time consuming and may not yield the desired results.

Level 1 background checks or a level 2 background check can be used to reveal where a person works as well. Once a person’s work location has been determined, the next step is putting the garnishment process in place and collecting the funds.

How Do You Get Someone’s Wages Garnished for Child Support?

Child support typically does not require a court order to garnish a person’s wages; however, there are specific procedures involved in determining the location of someone’s employment for garnishment purposes.

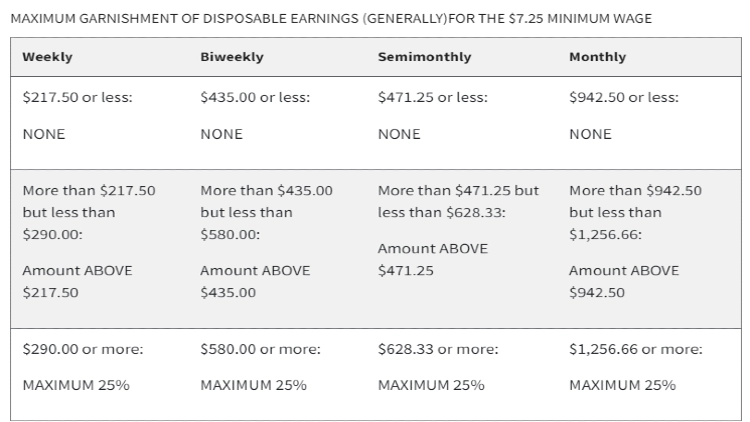

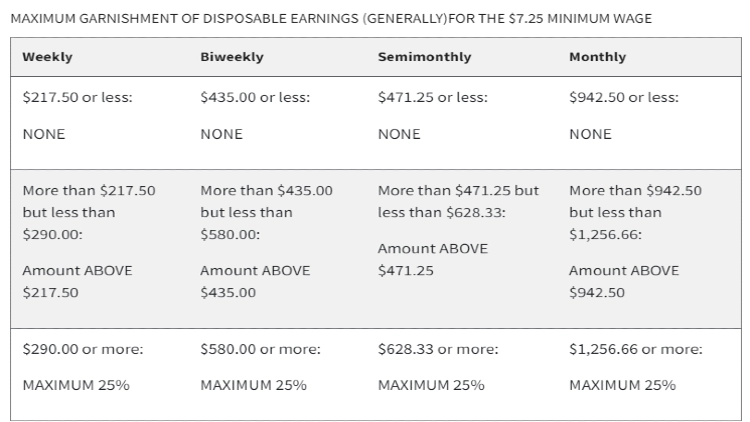

Federal laws set caps on how much of a person’s gross income or disposable income can be garnished, the employer has to be notified, and the procedures for distributing the money is set out.

Federal guidelines allow up to 65% of a person’s disposable income to be garnished for child support with the exact amount set by the state in which the obligation is established; however, there are some limits.

For example, if a person is making minimum wage, their income does not provide enough disposable income to order garnishment making that individual exempt from wage withholdings for debts such as child support.4

The percentage of disposable income that can be garnished varies from state to state. The table below shows the allowable amount.

| Percent of Disposable Income That Can Be Garnished Per State For Child Support |

| Up to 20% |

Up to 25% |

Up to 40% |

Up to 50% |

Up to 60% |

Up to 65% |

| West Virginia |

Minnesota

Missouri

New Hampshire

Ohio

Vermont

Washington |

North Carolina |

Arizona

Georgia

Kansas

Louisiana

Michigan

New Mexico

Oregon

Rhode Island

South Carolina

Texas

Wyoming |

Arkansas

California

Connecticut

Illinois

Indiana

Iowa

Maryland

Massachusetts

Mississippi

Nebraska

Nevada

New Jersey

North Dakota

Pennsylvania |

Alabama

Alaska

Delaware

Florida

Hawaii

Idaho

Kentucky

Maine

Montana

New York

Oklahoma

South Dakota

Tennessee

Utah

Virginia

Wisconsin |

Individuals can reach out to the local child support enforcement in their state to request assistance in getting unpaid child support through wage garnishment. The agent uses the formula adopted by the state to calculate child support and the amount of the garnishment.

Most states use a flat percentage method; however, the Melson Method is used in Delaware, Hawaii and Montana. This method calculates based on a certain standard of living for each party..

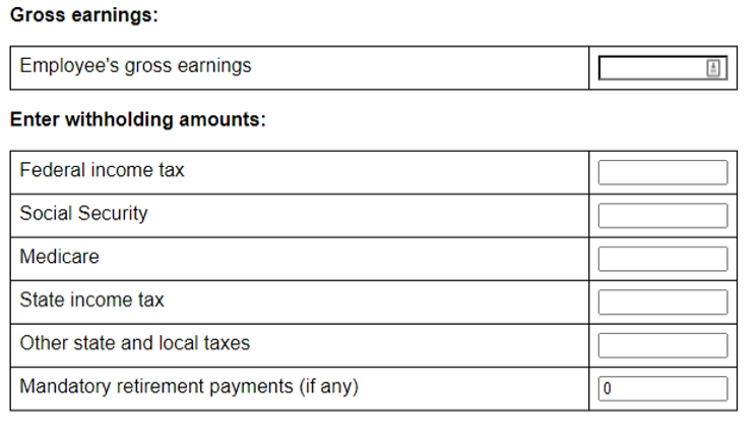

Regardless of the method used to calculate the amount to withhold from a person’s paycheck, the agent must consider the total number of children the person is financially responsible for, their gross salary, mandatory deductions, source of income, and amount of disposable income.5

Once the calculations are made, and it is determined the individual meets the necessary criteria to allow garnishment, the documentation is forwarded to the payroll department where the individual works.

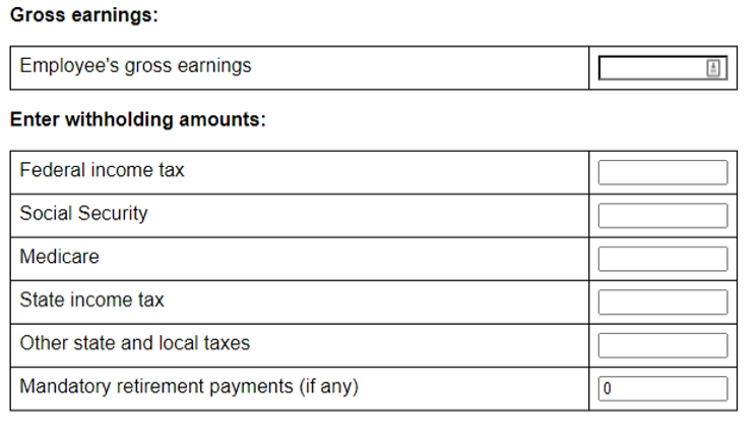

An example of what someone would fill out to determine their disposable incomes when it comes to wage garnishment.

The employer deducts the amount listed per paycheck in the garnishment order and sends it to the trustee for disbursement. The trustee is simply a third party, usually the child support enforcement agency, that is tasked with collecting the money and making sure it gets to the correct recipient.

The process for garnishment of wages for child support typically doesn’t require a court order, but the process for creditors and debt collectors is different.

How Can Creditors & Debt Collectors Find Someone’s Place of Employment for Garnishment?

Debt collectors and creditors do not have access to the Federal Parent Locator Service or new hire registries when it comes to locating a person who has stopped paying a valid debt, but there are ways these entities can locate where someone works for garnishment.

The most common way is for the creditor or debt collector to review the application for the loan or payment plan which would require listing a place of employment.

The creditor then has the right to contact the employer for the sole purpose of verifying the individual still works at that particular place of employment. The debt collector does have to follow laws and certain guidance and best practices.

Debtor Best Practices for Locating Employment for Garnishment Purposes

As a debtor, understanding the laws in the state where the debt occurred is crucial for identifying employment locations for garnishment and determining if garnishment is a viable option. Even neighboring states can have significantly different regulations regarding which debts can result in wage garnishment.

For example, in North Carolina, medical bills are not eligible for garnishment, but ambulance bills, which fall under government debts, are.6 However, in South Carolina, garnishment laws allow medical facilities to garnish wages and tax refunds to collect unpaid medical bills.7

What’s the Process for Creditors to Get Wages Garnished?

Unlike child support, which does not require a court order for garnishment, creditors must sue the individual in court and obtain a court order allowing them to garnish the person’s wages to cover the debt.

Once the court orders a person’s wages to be garnished, a certified copy of the order is presented to the employer who begins the garnishment process.

Similar to child support calculations, the court or creditor uses federal guidelines and formulas to see how much can be garnished from a person’s wages.

Payments are submitted to the trustee designated in the court order to be disbursed to the debtor.

How To See if Someone’s Income Is Being Garnished?

While a person’s actual wages may be a private matter, disclosing withholdings for the purpose of wage garnishment is not. When a person’s wages are garnished whether by a court order or through an administrative process, this information can and does show up on a person’s credit report as public information.

Wage garnishment falls under the same reporting requirements of debts under the Fair Credit Reporting Act, meaning they can appear on a person’s credit history for up to seven years. There are some protections for the individual, however.

Consumer Credit Protection Act prohibits an employer from firing someone simply because they have a wage garnishment. Additionally, wages garnishment cannot be used in a discriminatory manner to not hire someone for a position.8

There are some things a person can do when they are under threat of a wage garnishment.

Can a Non-Custodial Parent or Debtor Get Around Wage Garnishment?

It is possible in some cases to get around a garnishment. The quickest, most efficient way to stop a garnishment is to simply pay off the debt in full. This satisfies the obligation and stops the collection process.

For those unable to pay the debt in full, they can file bankruptcy to stop the wage garnishment process for court ordered debts from creditors or debt collectors. Child support garnishments are not stayed (or stopped) by a bankruptcy.

Another way to get around wage garnishment is to establish an undue burden that would be caused by the loss of income. However, this requires disclosure of all financial obligations such as additional children or ongoing medical expenses.

When someone fails to pay child support, taxes, student loans, or other debts, garnishment can be used to collect the money owed. A guide on locating an individual’s place of employment for garnishment purposes can assist custodial parents or creditors in recovering these debts.

Frequently Asked Questions

How Much Can Wage Garnishments Take From a Paycheck or Income?

The amount that can be taken from a person’s paycheck depends on the type of debt and the state in which it was incurred. Child support garnishments can be up to 65% of a person’s disposable income. Disposable income is the money left over after all mandatory deductions are taken from a person’s paycheck. Creditor garnishments are capped at 25% per federal law.

Is it Possible to Find Someone Using Their Social Security Number?

While it is possible to locate someone via their social security number, this identifier does not appear on all types of records. Additionally, certain databases that use SSN as an identifier cannot be accessed by the general public.

Does My Employer Have to Notify Me of Wage Garnishment?

There is no legal obligation for your employer to notify you that your wages will be garnished. Your employer is prohibited from discharging you from your job for one garnishment; however, if there are additional garnishments imposed after the first one, in other words multiple garnishments for multiple debts, your employer is not prohibited from terminating you.

How Do You Stop Wage Garnishment?

The most efficient way to stop garnishment is to pay off the debt in full. This will satisfy the obligation. Certain garnishments can also be stopped by filing bankruptcy; however, this method does not stop garnishment for child support. Appearing in court and proving garnishment would create an undue hardship may also stop the wage withholding process.

1 44% of Custodial Parents Receive the Full Amount of Child Support. (2018, January 30). Census Bureau. Retrieved October 20, 2022, from <https://www.census.gov/newsroom/press-releases/2018/cb18-tps03.html>

2 Office of Child Support Enforcement (OCSE) | The Administration for Children and Families. (n.d.). The Administration for Children and Families. Retrieved October 20, 2022, from <https://www.acf.hhs.gov/css>

3 New Hire Reporting | The Administration for Children and Families. (2021, September 17). The Administration for Children and Families. Retrieved October 20, 2022, from <https://www.acf.hhs.gov/css/employers/employer-responsibilities/new-hire-reporting>

4 Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act’s Title III (CCPA). (n.d.). U.S. Department of Labor. Retrieved October 20, 2022, from <https://www.dol.gov/agencies/whd/fact-sheets/30-cppa>

5 Guide, S. (2021, November 11). 4 Facts About Child Support and Garnishment. Upsolve. Retrieved October 20, 2022, from <https://upsolve.org/learn/child-support-garnishment/>

6 Ambulance Liens – Car Accidents. (n.d.). Wallace Pierce Law. Retrieved October 20, 2022, from <https://www.wallacepierce.com/durham-car-accident-lawyer/compensation-for-injuries/liens-and-subrogation/ambulance-liens/>

7 Hodges, D. (2022, May 27). “It needs oversight”: South Carolina law allows hospitals to garnish paychecks and tax refunds to collect medical debt. WBTV. Retrieved October 20, 2022, from <https://www.wbtv.com/2022/05/27/it-needs-oversight-south-carolina-law-allows-hospitals-garnish-paychecks-tax-refunds-collect-medical-debt/>

8 Federal Wage Garnishments. (n.d.). U.S. Department of Labor. Retrieved October 20, 2022, from <https://www.dol.gov/agencies/whd/wage-garnishment>