Level 4 Background Check vs Level 2 Check (Don’t Make This Mistake)

A level 4 background check differs significantly from a level 2 background check, while a level 3 check shows only minor differences.

Level 4 and 2 background screenings are often referred to interchangeably since they are both comprehensive screenings, but a level 4 goes that much further so don’t make this mistake of misidentifying these background checks as this may be a liability to a company and could potentially cost a company millions when screening c-suite applicants.

How Many Levels of Background Check Are There? What’s The Highest Level Background Check?

There are 4 primary background checks available to individuals, small companies, and corporations alike although the highest level some providers offer is a level 5 background check.

The different levels have different scopes, serving other purposes and selected based on this need:

Level 1 or Statewide Background Check: This is the lowest level and is a basic check that is named based and covers screening within state boundaries. This check would typically be used for pre-employment screenings and seeks to identify applicants on a local level by confirming social security numbers (SSNs) and date of birth (DOBs).

Level 2, FBI, or Fingerprint Background Check: This check is more comprehensive than level 1, is mostly finger-print based, and covers national and state levels. This check would be usually used to screen applicants who work with vulnerable members of society—children, disabled, and seniors and positions of responsibility. Florida mandates level 2 background checks and is defined in its statutes.1

Level 3, encompasses level 2 and includes education, employment, references, etc.: This background check is the most prevalent and, in addition to level 2 checks will scrutinize court records, criminal records, employment history as well as verifying education and any credentials. This check will also include drug testing results.

Level 4, encompasses level 3 and includes bankruptcy, and social media checks: Level 4 screening is most commonly associated with applicants being screened for executive positions. These screenings are typically not included in bulk background checks conducted for multiple applicants simultaneously because they involve detailed information such as bankruptcy records and social media reputation, and executives are hired less frequently than other positions.

As mentioned, some services allow employees to carry out a level 5 background check—a due diligence check for large acquisitions and the like. This digs further into an individual’s history, uncovering legal issues such as judgments, litigations, liens, etc.

What is a Level 4 Check & What Are They Used For?

Level 4 criminal background check is the combination of a level 3 background check that’s used for recruiting new executives, those moving into c-suite positions, and those in high-level financial positions. They include additional investigations to seek information that’s not on most background screenings. The additional investigation checks criminal records, bankruptcy records, social media accounts, sex offender data, media checks, terror watchlists, expunged and sealed convictions, etc.

Or in other words, level 4 screenings are high-level background checks dealing with those responsible for company management and trajectory. As such, it is of the utmost importance to ensure the operation of a company is not compromised in any way since a major slip-up in hiring could lead to a negative performance of the company, resulting in a decline in shareholders’ investments, embezzlement, poor public relations, or worse.

Therefore when choosing between a level 4 and a level 2 background check, companies are better off doing the former when hiring executives.

What Does a Level 4 Background Screening Include? What Shows Up?

A level 4 background screening will include information garnered from a level 3 screening and additional data. A myriad of data show up during a level 4 check, and these include:

- Criminal records or history of the applicant—both misdemeanor and felony records. This includes pending criminal cases of the subject of the check.

- Arrest records that led to convictions—in some cases, the check requester may want to view documents that did not result in convictions—dismissals.

- Employment history—including dates of employment, reasons for termination, job titles held, and performance issues in the past.

- References checks

- Verifying educational credentials—degrees, certifications, etc.

- Drug testing–this depends on the company and a drug screening was carried out on the subject.

- Motor vehicle record checks—For example, traffic violations, reckless driving, etc. Thirty percent of these checks have revealed violations and convictions such as vehicular homicide nationally.2 It should be noted that traffic violations cannot be used for hiring decisions as mandated by the Fair Credit Reporting Act (FCRA) law 15 U.S.C. §§ 1681-1681x.3

- Federal criminal records—these will include offenses such as tax evasion, fraud, children-related crimes, bank robbery, embezzlement, etc.

- Expunged and sealed convictions—can be viewed upon request, but these don’t usually appear.

- Bankruptcy records at a national level (federal)—This is done to demonstrate the financial proficiency of the applicant.

- Social media research—includes establishing the accounts operated by the applicant and ascertaining the kind of information that the applicant is engaged in when participating on social media.

- Sexual offender repository checks—both at the state and national levels.

- Terror watch list data— checking to see if the applicant is on any terror watchlist.

- Media checks—investigate if the applicant has had any negative news coverage, i.e., potentially being in scandals.

- Political connections—Investigation into any political connections that the subject of the check may have.

Bullets that are in bold and underlined comprise level 3 checks while those that are only in bold denote level 4 checks.

Level 4 Background Check Disqualifying Offenses

A level 4 employment background check will expose several offenses that will disqualify the applicant, rendering them inadequate for the position. Applicants convicted of crimes relevant to executive positions will be disqualified due to a level 4 screen check.

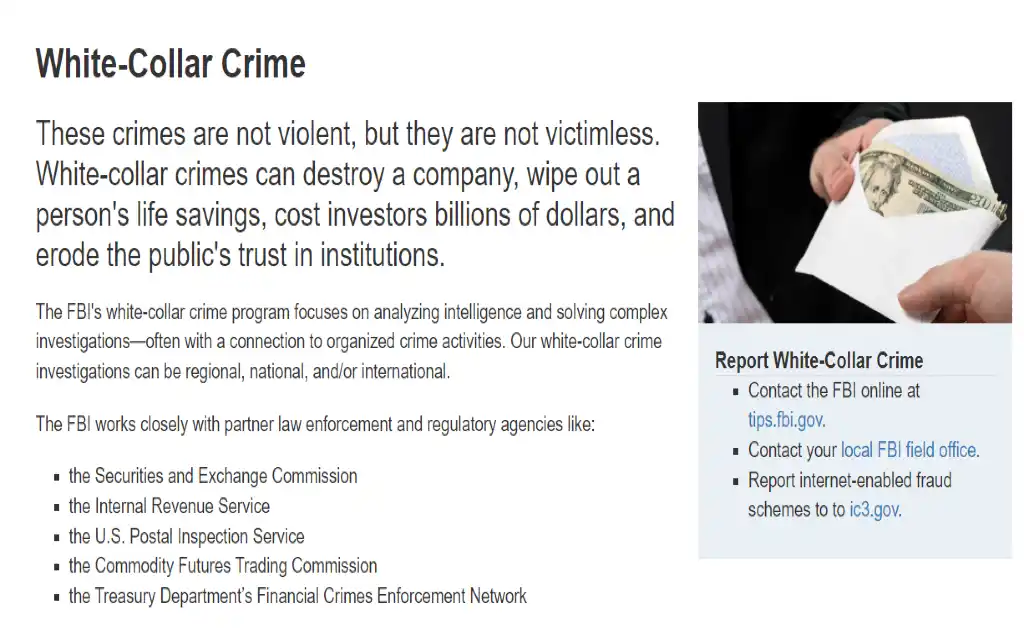

These crimes are classified by the Federal Bureau of Investigations (FBI) as white-collar crimes—crimes that are financially oriented and could destroy a company and cost them millions of dollars. They include:

- Corporate fraud—This type of crime is some form of dishonest act, i.e., fraud committed by executives to further themselves or a company. They include altering audited financial statements, hiding company debt, the deceptive practice of diverting funds to other than what is reported, hiding profits and losses, etc. This is a red flag for any company hiring an executive as it could cost the company millions in losses or fight legal battles resulting in the potential downfall of a company—a case in point being the fall of Enron.4

- Tax violations— that the subject of the check may have done. A background check does include tax records to determine if an executive has committed tax fraud, as this behavior may potentially carry over into their employment with the company.

- Insider trading— is buying and selling shares based on having some ‘inside information or a tip, thereby gaining an advantage over other shareholders.

- Money laundering— is an attempt to create an impression of money that came from crime as funds from legitimate sources—in essence, ‘cleaning’ money. For example, money that came from crime is placed into precious metals, crypto, etc. (known as layering), and retrieving these funds from these sources back into the criminal.

- Mortgage fraud— is deceiving banks by providing false information to obtain mortgages. This can either be by giving incorrect information in regards to income or simply embezzling equity from homeowners and lenders.

- Piracy— is commonly known as stealing intellectual or copyrighted property. This involves the theft of ideas, trade secrets, software, etc.

- Counterintelligence crimes—such as spying are also related to identifying any political connections the applicant may have. This is critical as it can lose the company’s intellectual rights or information in the form of economic espionage, which can be detrimental to the company and the nation.5

In addition to the white-collar crimes, the following would be considered disqualifying offenses:

- Poor credit history is typically a signal of financial incapacity. It displays a lack of economic foresight, which is a negative quality to have in an executive charged with a company’s management.

- Credentials, including educational or certifications that have been embellished, will permanently be disqualifying offenses as they show that the applicant lacks the aptness to fulfill the tasks required of an executive.

- If an individual was discharged from the military in a dishonorable manner, then this will likely bar them from these positions. They may not be for lower-level jobs, but executive positions usually require individuals to have clean records due to the high level of trust placed on them.

- Convicted crimes related to the individual’s character, such as sexual crimes, drug, and alcohol consumption, or even personality disorders such as narcissism or bipolar disorder, will usually disqualify applicants. As a result of these disorders, toxic leaders can make workplaces devoid of happiness or, worse, compromise the business strategies, plans, and structures of companies.

- Social media searches that reveal links with terrorist organizations or views contradicting the company’s ideals may bar applicants. Applicants appearing on terror watch lists would likely lead to disqualification.

It is clear that the amount of data retrieved from a level 4 vs a level 2 check is quite extensive— a natural consequence for the subjects that this screening targets.

How Long Does a Level 4 Background Screening Take?

Level 4 background screening varies in how long the screening takes, ranging from a few days to weeks depending on delays in retrieving information or inaccurate data provided; applicants may also delay attending drug testing. Most background checks usually take 1-3 days to complete. A level 4 screening typically takes 30 days or less to complete, unless an expedited FBI background check is requested.

Therefore, every effort should be taken to address these issues to avoid risking dragging on the process and a reputable and reliable agency will help make the screening much more efficient.

How to Pass a Level 4 Background Check or C Level Background Check

Knowing how to pass a level 4 or level C background check is imperative to be eligible for a lucrative job. Specific steps can help someone pass these screenings before an employer initiates one:

- Perform a self-diagnosis—in other words, run a self-background check to see what results come up for the check. This can be accomplished either through third-party sites or by visiting government resources such as law enforcement agencies; the former saves time as many checks can be completed concurrently under one platform.

- Raising concerns—Individuals can be open with their prospective employer about any issues they may know about their history. This may also help applicants gain the trust of future employers. Employers typically do not bar all applicants with criminal records as this may lead to lawsuits.

- Credit history—When a self-credit history check is done, an individual may have a chance to rectify wrong information on the report by notifying the credit bureaus.

- Employment laws—Familiarization with employment laws goes a long way to informing applicants of their rights; applicants may also request copies of records from previous employers.

Keeping all this in mind, those running a level 4 background check or undergoing one should now understand the intricacies and the difference between a level 2 background check so they’re not mistaken and the correct one is performed, thus ensuring both employers and applicants make better-informed decisions.

Frequently Asked Questions

Is a Level 4 Security Clearance the Same as a Level 4 Background Check?

No, they are not the same. While a level check screens for criminal history and other histories, a level 4 security clearance is an authorization issued by U.S. government agencies to give access to restricted information pertaining to national security.

Level 4 security clearances are required for employment as government contractors, military positions and those involving intelligence roles. Some jobs within the federal government will also require security clearance.

Eligible candidates are investigated via criminal history checks, fingerprints, and even questioning acquaintances, etc. Investigators then grant level 4 security clearance upon cross checking the investigation results against the Office of the Director of National Intelligence (ODNI) guidelines.

1 Senate, T. F. (2019, July 1). 2019 Florida Statutes. Retrieved from www.flsenate.gov: <https://www.flsenate.gov/laws/statutes/2019/397.4073>

2 Chavers, Mike (2007, August 13). Getting the lowdown: Background checks become powerful tools for businesses. Retrieved 2022, from www.bizjournals.com: <https://www.bizjournals.com/triad/stories/2007/08/13/focus2.html>

3 Constitution, U. S. (2022, July 18). Code of Federal Regulations. Retrieved 2022, from www.ecfr.gov: <https://www.ecfr.gov/current/title-16/chapter-I/subchapter-F>

4 Congress, U. (2002, January 24). THE FALL OF ENRON: HOW COULD IT HAVE HAPPENED? Retrieved 2022, from www.govinfo.gov: <https://www.govinfo.gov/content/pkg/CHRG-107shrg78614/html/CHRG-107shrg78614.htm>

5 Congress, U. (2011). CHAPTER 90—PROTECTION OF TRADE SECRETS. Retrieved 2022, from www.govinfo.gov: <https://www.govinfo.gov/content/pkg/USCODE-2011-title18/html/USCODE-2011-title18-partI-chap90.htm>