10 Year Background Check States vs 7-Year States (Full List & Laws)

In the United States, states with 10-year background check regulations have laws restricting the reporting of negative information beyond a decade, though there are exceptions based on the type of negative information being reported. Furthermore, other states have 7 year background checks and occasionally state and federal laws can overlap so a full list of states and their respective laws are noted below.

To determine whether negative information will appear on a background check after 7-10 years, it is crucial for the person to have knowledge of their state’s local laws, federal laws such as the FCRA, and to understand which law is applicable to their records, as there are differences in the duration that bankruptcies, criminal records, or negative credit remarks are managed.

How Many Years Back Does a Criminal Background Check Go? 10 Year States vs 7 Year States vs Other Laws

What can be included in a background check and how far back the screening can go is determined by state and federal laws. Laws vary from state to state, but each state must abide by the federal statutes surrounding commercial use background checks, including lookback limits and what is covered in those limits.

There are a handful of states that have a strict 7 year lookback rule that aligns with the Fair Credit Reporting Act (FCRA).

The remaining states allow background checks to span 10 years or more when searching a person’s criminal history; however, credit history is still subject to the same rules as 7 years states under the FCRA. The variation of these rules depends on the level of screening requested by the agency or employer.

For instance, level 1 background checks, which are considered the most basic level screenings a person can undergo, typically adhere strictly to the 7 or ten year lookback period in the state where the screening occurs.

A level 2 background check, which involves fingerprint-based screening, usually extends beyond the seven or ten-year limit for criminal records and credit history. Employment and education verifications that can be included in these screenings are not subject to lookback limitations.

A level 3 background check, which delves much deeper into a person’s background, is typically reserved for positions of much higher authority or a higher base salary. As such, these screenings are not subject to the lookback limitations based on the added responsibility associated with the role.

This type of screening is also done on individuals who may be working with vulnerable populations which means the lookback period is not limited.

A level 4 background check, which may involve personal interviews with individuals associated with the person, is also not subject to lookback limits, as these positions often entail high responsibility and may involve national security, national financing, or national health.

Knowing the level of screening a person will undergo can help determine how far back the report will go.

Full List of States Conducting 10-Year Background Checks

There are only a few states that adhere to the same seven-year background check rule outlined by the FCRA guidelines. Most states have a 10 year lookback (or more) period for background checks, and these are listed below:

- Alabama

- Alaska

- Arizona

- Arkansas

- Connecticut

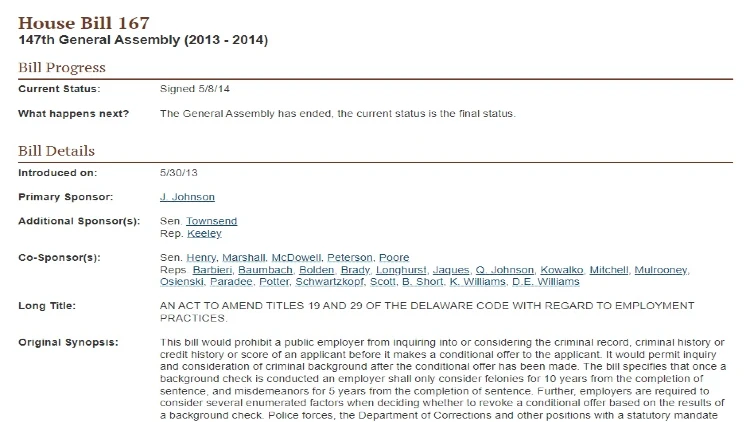

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Louisiana

- Maine

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- New Jersey

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

- Wyoming

In these states, the background check can go back as far as 10 years or more, with the limitations on non-convictions still subject to the FCRA rule that states non-conviction information (when allowed by state law) cannot go back further than 7 years.

Other laws in the states may limit what can show up on a background check as well, or when an employer may inquire about criminal history or run a background check. These laws, called Ban the Box statutes, are designed to give individuals with a criminal record a better chance at employment.

The laws that govern background checks in each of the 10 year states are discussed in the next section.

Laws & Regulations for All States With a 10 Year Look Back Period for Background Checks

All states, regardless of the state laws, must adhere to the Fair Credit Reporting Act seven year rule regarding credit history (with bankruptcies being the exception allowing for a 10 year lookback) and non-convictions.1

In addition, federal agencies with workspaces within states must also follow the federal Ban the Box law, known as the Fair Chance to Compete for Jobs Act, which makes it unlawful for federal agencies or business that contract with the federal government to ask about a person’s criminal background before a conditional offer of employment has been made.

Below is a table outlining the states conducting 10-year background checks, accompanied by links to the relevant state laws concerning screenings.

The statutes listed above limit when inquiries can be made into a person’s criminal past, what can be included in the record and how non-convictions are treated on background reports. These state laws are in addition to the FCRA, not a replacement for the federal statute.

It’s also important to know when the clock starts ticking on a record’s lookback period.

When Does the 10 Year Look Back Period Start for Criminal Background Checks?

Knowing which states have at least a 10 year lookback period is the first step, but it’s also important to know when that clock starts ticking. Knowing when the 10 year period starts helps individuals prepare for what may appear on a background check.2

When it comes to non-convictions or dismissed charges, the clock starts when the charges were first filed, not the date it was dismissed or the individual was found not guilty. This was when the 9th District US Court of Appeals made a final ruling on this aspect of the background check lookback period in the case of Moran vs The Screening Pros where a charge that was ultimately dismissed showed up on a background check years after it should have not appeared.3

When it comes to convictions, the waters get muddy since convictions do not go away unless they are expunged or sealed by a judge. The lookback period for a conviction can start on the date of disposition, release from prison, or date of parole.

This means that the clock starts when the person is found guilty or pleads guilty, or when the person finished their sentence completely (either through being released from prison or completion of parole).4 Knowing how long a record can appear on a background check is key to preparing for one during the hiring process.

While most states have a 10 (or longer) rule regarding criminal convictions, there are some states with a seven year lookback period.

States With a 7 Year Background Check Timeframe for Criminal Records

There are 10 states that currently limit the lookback period for convictions to seven years unless the position pays a certain amount, or the job requires a longer lookback period due to public health and safety concerns. These states are listed below:

- California

- Colorado

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Montana

- Nevada

- New Hampshire

- New Mexico

- New York

- Texas

- Washington

Statutes in these states line up with the FCRA guidelines regarding lookback periods. Most screenings only span a seven year period, but for positions paying more than $25,000-$75,000 annually, or those in law enforcement, corrections or positions working with vulnerable populations, the lookback period can be much longer.

The FCRA has been mentioned several times throughout this article, and is the basis for a great deal of regulations placed on background checks. When it relates to credit history, the standard lookback period for negative data is seven years meaning that negative credit history older than seven years cannot be reported on a background check unless it meets one of the exceptions outlined in the Act.

More on these exceptions will be covered in the next section.

In addition to defining what qualifies as negative information, the FCRA also orders that the subject be notified in writing of any adverse action taken based on the information provided in a background check. For example, if a person is denied housing based on a screening, the person must be notified in writing of the decision, how the decision was made, and what steps the person can take.5

FCRA Exceptions

While the normal lookback period is allowed under the FCRA guidelines, there are some exceptions to the rule. For example, negative credit history in most cases can only span seven years; however, Chapter 11 bankruptcies can appear on a commercial background check for up to 10 years from the date the bankruptcy was adjudicated in court.6

Regarding child support obligations, the FCRA guidance states that any obligations that are more than 7 years old can appear on the background check but must be annotated as an older record if the child support is still an unpaid obligation. This simply means any child support that was ordered to be paid and was not can appear on the background check even if it is older than seven years until the child support obligation has been satisfied.6

Applications for very large lines of credit or life insurance policies are also exempt from the seven year rule established by the FCRA. Knowing these exceptions can help prevent surprises on a background report.7

In addition to the exceptions listed above, FCRA guidance limits non-convictions to a seven year lookback period as well. Recognizing that even non-convictions can have a negative impact on a person’s ability to get a job, making sure these do not show up on background checks have become priorities for certain states as well.

States Who Treat Convictions vs Non-Conviction Reporting Differently

As stated earlier, the federal government took steps to limit how long non-convictions can appear on a person’s background check report to seven years under the FCRA guidelines; however, some states took additional steps to further level the playing field for applicants.

The appearance of dismissed charges on a background report, specifically for 10-year background checks, varies depending on a specific state.

Below are the states that have added protections to applicants with charges but no convictions on their records:

- California: Dismissed charges cannot appear on a background check regardless of the amount of time that has passed since the court’s action in the case.

- Colorado: When a charge is dismissed, the defendant can ask for the matter to be sealed immediately following the court’s action removing it from a background check.

- Delaware: State law allows for mandatory expungement of records when the matter was resolved in the favor of the defendant (acquittals and dismissals).

- Georgia: Dismissed charges are removed from public record once the order of dismissal is entered.

- Hawaii: Dismissed charges can only be viewed by law enforcement or governmental agencies, not as part of an employment background check or personal screening.

- Indiana: Dismissed charges must be expunged as soon as the dismissal is entered into the court’s record.

- Kentucky: 30 days after dismissal of charges that occurred on or after 15 July 2020 are automatically removed from public record.

- Maine: Arrest records in dismissed charges are confidential; however, court records are not.

- Maryland: Criminal records after 1 October 2021 are automatically expunged after three years if the case was dismissed.

- Michigan: Arrest and court records are destroyed when cases are dismissed.

- Missouri: Just like Hawaii, records in Missouri are available only to law enforcement when the matter is dismissed.

- Montana: Dismissals following deferred prosecutions are only accessible by law enforcement, not as part of commercial background checks.

- Nebraska: Dismissals are only open to law enforcement agencies, not the general public.

- New Hampshire: Cases dismissed after 1 January 2019 are automatically removed from the public record.

- New Jersey: Dismissed cases are expunged immediately following entry of the dismissal order.

- New York: Automatically seals dismissed records from the public.

- North Carolina: Starting 1 December 2021, charges that are dismissed are automatically removed from the public record.

- Oklahoma: Dismissal can be expunged automatically, but the defendant cannot have a felony conviction on record or pending charges.

- South Carolina: Dismissals are automatically expunged in summary court matters.

- Utah: All dismissed cases after 1 May 2020 are automatically removed from the public record.

- Wyoming: If there is no objection by the prosecution within 180 days of a dismissal, the matter is removed from public record.

Regarding dropped charges, it’s important to consider their visibility on a background check. As with dismissed matters, dropped charges can and do appear on a background screening as a non-conviction, unless they meet the criteria outlined above for non-convictions.

Unless a state allows automatic relief when charges are dismissed a person must file a petition requesting an expungement. Expungement of a record ensures it won’t appear on reports from states conducting 10-year background checks.

States With Ban the Box Laws

Another protection that applicants have is ban the box laws that limit when employers can dive into a person’s criminal history. In most cases, the background check cannot be conducted until after the person has been scheduled for an interview or given a conditional offer of employment.8

The list below are states (or cities within these states) that currently have ban the box laws:

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- Tennessee

- Utah

- Vermont

- Virginia

- Washington

- Wisconsin

The federal government also passed the Fair Chance to Compete for Jobs Act to give federal applicants and those working for federal contractors a better shot at employment even if the person has a criminal record.

Ban the box laws aim to prioritize a person’s qualifications over their criminal history during the initial stages of employment consideration, preventing the use of a criminal record as the sole basis for disqualification. It’s advantageous for individuals to reside in states with lookback period limitations, as a misdemeanor conviction can potentially remain on their record indefinitely. The record is also viewed in the light of whether or not the charge would create a direct negative impact on the person’s ability to perform the job duties.

What States Don’t Share Criminal Records?

In the end, criminal records are shared among states to varying degrees, regardless of whether they conduct seven-year or 10-year background checks. Unless the matter has been expunged or sealed by a court, or is in a state that allows automatic erasure for non-convictions, the matters can and do get shared with other states, and can be accessed by commercial background check agencies for reports.

Background checks can display out-of-state criminal history; however, the availability of such information depends on the laws governing that particular state.

There are 12 states, however, that have given judges the authority to place strict limits on criminal records that can be shared with the public as listed below:

- Arkansas

- Connecticut

- Kansas

- Indiana

- Louisiana

- Massachusetts

- Minnesota

- Missouri

- New Hampshire

- Oregon

- Utah

- Washington9

Out of the twelve states listed (Arkansas, Connecticut, Indiana, Louisiana, Minnesota, Missouri, Oregon, and Utah), eight are classified to conduct 10-year background checks, permitting a longer observation period compared to the standard seven years.

Despite all the efforts states have taken to limit the damages poor credit history or a criminal record can have on a person’s ability to get a job or secure housing, there are some steps a person can take to make sure items that show up on a report erroneously are corrected. Individuals should take advantage of the annual free credit reports through all three major credit reporting agencies.

Offered as a service by the federal government, a person can run all three credit reports, compare the data and take steps to dispute items that should not be on the report. Disputes can be filed directly with the reporting agency, or they can be filed with the Federal Trade Commission (FTC).10

When information is showing up on a background check that is older than seven years (or 10 in the case of bankruptcies), this should also be reported to the FTC. Another reportable item is when adverse action is taken without notification to the applicant, or a background check was conducted illegally.

Running a background check without the person’s authorization is not permissible; written consent must be obtained before conducting or using the background check for hiring or housing decisions.11

Regarding criminal records, one of the best ways to remove information from a person’s background report is to have the matter expunged or sealed from public view. Each state has its own rules and laws regarding expunging records.

Some states automatically expunge non-convictions while others do not provide expungement relief at all.

When a criminal record appears on a person’s background report, they should hire an attorney to explore expungement. When expunged or sealed records still show up on a background check, individuals can reach out to the attorney general in their state to clear up the matter.

Understanding the procedures of criminal history screenings in states conducting 10-year background checks assists individuals in preparing for pre-employment screenings or housing applications, providing insight into potential contents of the report.

Frequently Asked Questions

What Is a 10 Year Background Check?

A 10 year background check is simply a screening that looks at the last 10 years of a person’s criminal history. Credit screenings can only span 10 years when the matter involves a bankruptcy or unpaid child support obligations.

Do Felonies Show Up on a Background Check After 10 Years?

Yes, felonies can and do show up on a background check after 10 years when the matter resulted in a conviction.

The duration of a felony on your record can be indefinite.

Some felony non-convictions may automatically be expunged upon dismissal. Additionally, some states provide the opportunity to expunge non-violent felony convictions or felony non-convictions.

1 Gaynor, A. (n.d.). Fair Credit Reporting Act. Federal Trade Commission. Retrieved February 10, 2023, from <https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act>

2 Q&A: What’s Included in an Employment Background Check? (2017, September 6). Indeed. Retrieved February 10, 2023, from <https://www.indeed.com/career-advice/finding-a-job/whats-included-in-an-employment-background-check>

3 Maurer, R. (2019, June 12). FCRA’s Seven-Year Reporting Window Begins with Charge, Not Dismissal. SHRM. Retrieved February 10, 2023, from <https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/fcra-seven-year-reporting-window-begins-with-charge-not-dismissal.aspx>

4 50-State Comparison: Limits on Use of Criminal Record in Employment, Licensing & Housing. (n.d.). Collateral Consequences Resource Center. Retrieved February 10, 2023, from <https://ccresourcecenter.org/state-restoration-profiles/50-state-comparisoncomparison-of-criminal-records-in-licensing-and-employment/>

5 FCRA Final Notice of Adverse Action. (n.d.). SHRM. Retrieved February 10, 2023, from <https://www.shrm.org/resourcesandtools/tools-and-samples/hr-forms/pages/fcrafinalnoticeofadverseaction.aspx>

6 Fair Credit Reporting Act. (n.d.). Federal Trade Commission. Retrieved February 10, 2023, from <https://www.ftc.gov/system/files/ftc_gov/pdf/545A-FCRA-08-2022-508.pdf>

7 How long does negative information remain on my credit report? (2020, September 1). Consumer Financial Protection Bureau. Retrieved February 10, 2023, from <https://www.consumerfinance.gov/ask-cfpb/how-long-does-negative-information-remain-on-my-credit-report-en-323/>

8 guide, s. (2021, October 1). Ban the Box: U.S. Cities, Counties, and States Adopt Fair Hiring Policies. National Employment Law Project. Retrieved February 10, 2023, from <https://www.nelp.org/publication/ban-the-box-fair-chance-hiring-state-and-local-guide/>

9 Love, M. (2017, March 9). Restrictions on access to criminal records: A national survey. Collateral Consequences Resource Center. Retrieved February 10, 2023, from <https://ccresourcecenter.org/2017/03/09/restrictions-on-access-to-criminal-records-a-national-survey/>

10 FTC. (n.d.). Disputing Errors on Your Credit Reports | Consumer Advice. Retrieved February 10, 2023, from <https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports>

11 Gaynor, A. (2016, April 14). What Employment Background Screening Companies Need to Know About the Fair Credit Reporting Act. Federal Trade Commission. Retrieved February 10, 2023, from <https://www.ftc.gov/business-guidance/resources/what-employment-background-screening-companies-need-know-about-fair-credit-reporting-act>